Our 7 Point Retirement Planning Checklist Has You Covered

Do you have a retirement planning checklist that is up-to-date? Unfortunately, most people don’t, and what’s worse, they don’t even have a retirement plan in the first place. Here is our 7-point retirement planning checklist:

- Evaluate Your Retirement Income

- Strategize Your Spending Budget

- Get Out of Debt

- Budget Your Time

- Map Out Your Healthcare Plan

- Prepare for the Possibility of Long-Term Care

- Consider Purchasing a Fixed Index Annuity

Without a retirement planning checklist or detailed plan in place, it is extremely difficult to feel confident about retiring. You can’t have confidence in something that doesn’t exist.

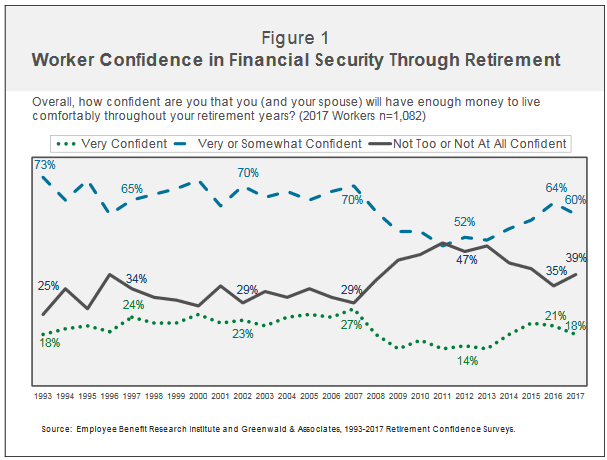

Did you know that only 18 percent of the American workforce feels very confident in their retirement plan?

Want to change that? Read on to discover ways you can be more prepared for your future with our 7 point retirement planning checklist. We will also provide you with some valuable resources in each section to help you along in your retirement planning journey.

1. Evaluate Your Retirement Income

The first step in our retirement planning checklist is to take a look at how much income you’ll have at your fingertips in retirement. Make a list of all your expected sources of retirement income and how much monthly revenue you expect from each source. Don’t forget to think outside the box!

For your convenience, we have designed a Microsoft Excel Retirement Income Worksheet to help you estimate your monthly and annual income once you retire. Download this worksheet and keep the figures handy because you will need them in other worksheets in our checklist as you put your retirement plan together.

Here are a few types of retirement income sources to help you started:

- Social security

- Pensions

- Rental properties or other real estate investments

- Turning a hobby or skill into a part-time job

- Traditional savings accounts

- Royalties

- Home equity

- Owning or selling a small business

- Income from retirement saving (such as 401k, IRA, stocks, and bonds, annuities, etc.)

- Fixed Index Annuities

Once you have determined the amount of income you’ll have available during your retirement, the next step in our retirement planning checklist is to…

2. Strategize Your Spending Budget

What will your life during retirement look like?

Will you be traveling more? Will you be spending parts of the year in different parts of the country? Will you be downsizing your home?

It’s important to think about the aspects of your life that will be changing (drastically or otherwise) once you retire.

Once you see the big picture of how you will be living, you can then figure out how much and on what you will be spending. Be as specific as possible when you outline your expenses.

And of course, it’s always better to overestimate than to underestimate. Life is full of unexpected surprises, and along with those surprises often comes unexpected expenses. Prepare for the unexpected.

As you put together your list of expenditures, be sure to include items such as your house payment or rent, utilities, maintenance expenditures, insurance, clothing, groceries, auto expenses, entertainment, healthcare expenditures, travel/vacations, gifts, hobbies, TAXES, charitable contributions, personal products, and any other expenses you can think of.

For your convenience, we have designed a Microsoft Excel Retirement Budget Worksheet to help you estimate your monthly and annual expenses once you retire. Download the FREE budget worksheet to help you lay out your monthly expenditures and see how your retirement plan measures up.

3. Get Out of Debt

One of the biggest drains on your savings outlook can be paying off the things that you chose to finance over the years along with paying the interest associated with each item. Figure out now how you can pay off these debts as quickly as possible. The earlier you can pay off your debts, the more years you will have to save money.

We have created an Excel template for you to use to help with debt reduction. Download our Debt Reduction Worksheet using the green download button.

Once you have downloaded the spreadsheet, enter all your outstanding loans in the Creditor column. Be sure to include your mortgage, car loans, credit cards, medical bills, student loans, and any other outstanding loans that you have. Enter the interest rate and monthly payment for each loan.

Now enter your monthly debt reduction budget in the spreadsheet to calculate your surplus or shortfall as compared to your monthly payments.

If you have a surplus, we recommend applying the additional money towards either the loan with the highest interest rate or the loan with the lowest balance. If you can knock out the loans with low balances, then the monthly payments that you were using for these loans can be applied to other loans.

It can be quite rewarding to see the progress made towards reducing debt!

There are lots of great free resources and advice online to help you get out of debt. The less debt you have, the more you can save, and the more prepared you’ll be for your retirement.

4. Budget Your Time

The adage, “Time is money” is indeed true. Thus the next step is sketching out how much time you’ll dedicate to hobbies, spending time with family, traveling, volunteering for your favorite cause, and of course, possible ways to increase your income.

5. Map Out Your Healthcare Plan

Next on our retirement planning checklist is to map out your healthcare plan.

Let’s be honest, healthcare has changed in the past several years, and it will continue to change. Healthcare is and will continue to be an expensive, necessary part of life.

Even if you plan on using Medicare, be aware that only 62 percent of your healthcare expenses will be covered, on average. Prepare yourself by educating yourself on the various options.

Do your research and figure out what type of healthcare coverage you’ll want to have for retirement. As stated previously, there are tons of resources and blogs that will aid in your decision as well as your strategy for your expenses, which will, of course, include your healthcare.

Below we have compiled a handy list of resources to help you along in the decision-making process concerning your healthcare in retirement.

What is Medicare?

- What does Medicare Part A cover?

- What does Medicare Part B cover?

- What is Medicare Part D Drug Coverage?

- What is Medicare Supplemental Insurance (Medigap)?

- Amac – Association of Mature American Citizens

- AARP – American Association of Retired Persons

- Health coverage for retirees

- What is Medicaid?

6. Prepare for the possibility of long-term care – Home Health, Assisted Living, or Nursing Home Care

One possibility that no one likes to consider is long-term care, either at home, in an assisted-living facility, or nursing home care. There may be a point in your retirement that you are no longer able to care for yourself without the help of others.

It is an uncomfortable topic. However, it’s vital to address because long-term care is another high expense that could be very real for many retirees.

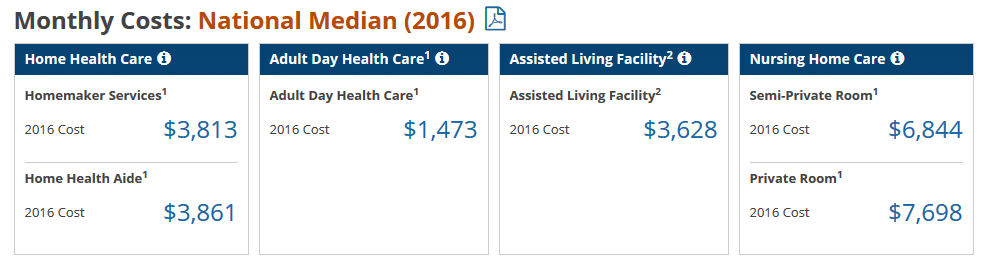

According to Genworth, the national median monthly costs in 2016 for long-term care were as follows:

7. Asset-Based Long-Term Care Insurance

One possible way to pay for the rising costs of long-term care is a product called Asset-Based Long Term Care Insurance.

The Pension Protection Act of 2006 paved the way for individuals to protect their retirement accounts from the exorbitant costs of long-term care. The PPA plans use an asset-based life insurance method that allows you to move money from an existing retirement account to an asset class that could generate up to nine times your money in tax-free benefits that pay for long-term care. These plans can help pay for licensed home caregivers, adult day care services, and skilled nursing facilities. If you end up not needing care, you can easily access your principal or leave it as a tax-free death benefit for your heirs.RELATED >> Rising Healthcare Costs Draining Retirement Savings

RELATED >> Long-Term Care Costs and How to Pay for Them

RELATED >> Long-Term Care Insurance – A Little TLC with LTC

Does Medicare cover long-term care?

Unfortunately, Medicare does not cover long-term care stays such as assisted living or nursing homes.

Using Medicaid for long-term care

Medicaid might be able to help cover these costs of long-term care at some facilities. Keep in mind that not all nursing homes or assisted living facilities accept Medicaid as a form of payment. While Medicaid helps cover the cost of nursing home care, it only partially covers the cost of assisted living facilities. Using Medicaid for long-term care varies by state, so you’ll want to do your homework before you plan to rely on Medicaid to cover the costs of long-term care facilities.

Medicare.gov is a great resource when researching how to pay for a long-term care facility.

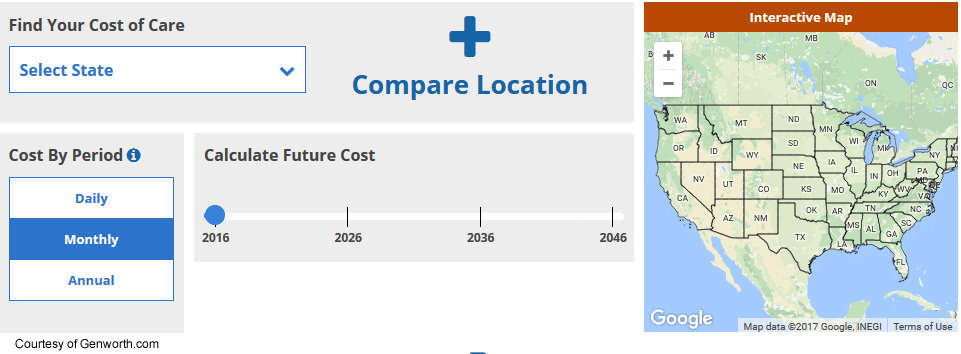

Compare Long-Term Care Costs

Genworth has built a wonderful tool to help you research the costs of long-term care by state or to compare locations. You can search costs by period – daily, monthly, or annually. You can also calculate the future costs of long-term care. Click on the image below to use Genworth’s long-term care cost tool.

Various Methods Used to Pay for Long-Term Care

- Long-term care insurance

- Medicaid

- Asset-Based Long-Term Care Insurance

- VA for veterans and spouses of veterans

- Reverse mortgage

- Home sale

- Cash

- Retirement accounts – 401(k)s, IRAs, etc.

- Stocks and Bonds

- Some life insurance policies (Accelerated Death Benefit)

Consider purchasing a fixed index annuity

Number seven on our retirement planning checklist is to consider purchasing a fixed index annuity.

There are so many ways to provide income for your future, but not all of them need to be as risky as investing in the stock market or real estate. Consider the option of Fixed Index Annuities (FIAs) through Annuity Watch USA.

Fixed Index Annuities are a great way to provide guaranteed income for life because they combine the positive aspects of fixed and variable annuities while eliminating the negative aspects thereof. Here are some of the key features of fixed index annuities:

- Fixed index annuities offer growth potential while at the same time, principal protection. Your annuity has the opportunity to benefit from stock market gains, but your principal is protected from stock market losses. Therefore, you cannot lose money in the event of a stock market crash.

- Unlike 401(k)s and IRAs, FIAs have no limit on the amount of money that can be placed in them.

- FIAs accrue tax-deferred. Premiums paid into your FIA are allowed to grow tax-deferred until funds are withdrawn.

- FIAs offer a guaranteed lifetime income as well as an optional death benefit.

- There are multiple accumulation and distribution (payout) options depending on your options selected at the time of your annuity purchase. The payout rate is the #1 key to maximizing your retirement income potential.

- Inflation-protected annuities help mitigate the risk of your spending power being impacted not if, but when inflation rises.

- In the event of a financial emergency, a portion of your premiums may be withdrawn for a fee.

Overall, FIAs can be a smart way to enjoy a steady paycheck for life. They are a great product to consider if you are looking for a retirement income strategy that protects your principal while at the same time, has upside potential. We suggest discussing your options with an annuity expert to see if an FIA would be a fit for your retirement plan.

Checklist Bonus

If there were one thing we would add to our retirement planning checklist, it would be to suggest that you meet with a retirement planning professional to explore your options. You don’t want to find out too late that your plan leaves you coming up short on money during retirement.

Conclusion

Planning for retirement is one of the most important, but often overlooked responsibilities in life. The earlier you start planning, the better off you will be later. Ask almost any retiree you meet if they started planning for retirement early enough, and you will likely hear a resounding “No.”

If you take away only one item from this checklist, it should be this: DO YOUR RESEARCH. The more information you have in regards to your specific financial needs for retirement, the better you can prepare for it.

Develop your plan and get it down on paper. Then review, review, and review again. At least once a year, review your retirement plan to make sure you are on track to reach your goals. Modify your plan as required. Get help as needed.

Retirement planning is not a one-and-done endeavor; you’ll want to keep it on the front burner. New strategies and investment opportunities pop up every day. You’ll want to keep your ear to the ground and be open-minded about new products that become available that could be a good fit to help you reach your objectives.

We have a variety of tools available to help you put your plan together. We have a free video series on fixed index annuities called, “Securing Your Retirement Future.” We have a retirement income plan analysis to help you see how your current plan measures up. We can help with 401(k) and pension rollovers, upgrades to your life insurance, comparing annuity rates, and many other related services.

Keep in mind, at Annuity Watch USA, we are here to help. If there is anything we can do to help, please don’t hesitate to ask. We look forward to hearing from you soon!

Disclosure: For informational and educational purposes only. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

Indexed annuities are insurance contracts that, depending on the contract, may offer a guaranteed annual interest rate and some participation growth, if any, of a stock market index. Such contracts have substantial variation in terms, costs of guarantees and features and may cap participation or returns in significant ways. Any guarantees offered are backed by the financial strength of the insurance company, not an outside entity. Investors are cautioned to carefully review an indexed annuity for its features, costs, risks, and how the variables are calculated. A fixed annuity is intended for retirement or other long-term needs. It is intended for a person who has sufficient cash or other liquid assets for living expenses and other unexpected emergencies, such as medical expenses. A fixed or indexed annuity is not a registered security or stock market investment and does not directly participate in any stock or equity investments or index.

DeWitt & Dunn does not provide tax/legal advice. Please consult with the appropriate professional.

Links to third-party websites are provided as a convenience. DeWitt & Dunn does not endorse nor support the content of third-party sites. By clicking on a third-party link, you will leave this website where privacy and security policies may differ from those practiced by DeWitt & Dunn.